By: Edgar Velasco Senior Associate, State Budgets

Over the course of the COVID-19 pandemic, as many as 40 million jobs have been lost and unemployment claims have reached a peak of 23.08 million. This unexpected and record-breaking increase has put a strain on states’ unemployment trust funds. The federal government took an unprecedented action by supplying a temporary extra $600 a week supplemental benefit to help those out of work as they wait for the economy to reopen and their jobs to return.

States have a great deal of autonomy in how they run their unemployment insurance programs, but federal law has established Unemployment Compensation benefits as an entitlement and requires states to pay claims promptly. During past recessions, when a state’s Unemployment Trust Fund balance is insufficient to cover its obligations, they are able to borrow funds from the federal loan account within the Unemployment Trust Fund.

When states take a federal loan from the trust fund, they are required to repay the amount with interest. In the past, states have looked to payroll taxes and cuts to social aid benefits as sources of revenue to repay their federal debt. These actions can dampen economic growth and job creation in the best of times, but for states with high corporate, income and payroll taxes some recent shifts to remote work may also mean less revenue as more companies make remote working permanent and higher earning employees begin to move to states with lower tax burdens.

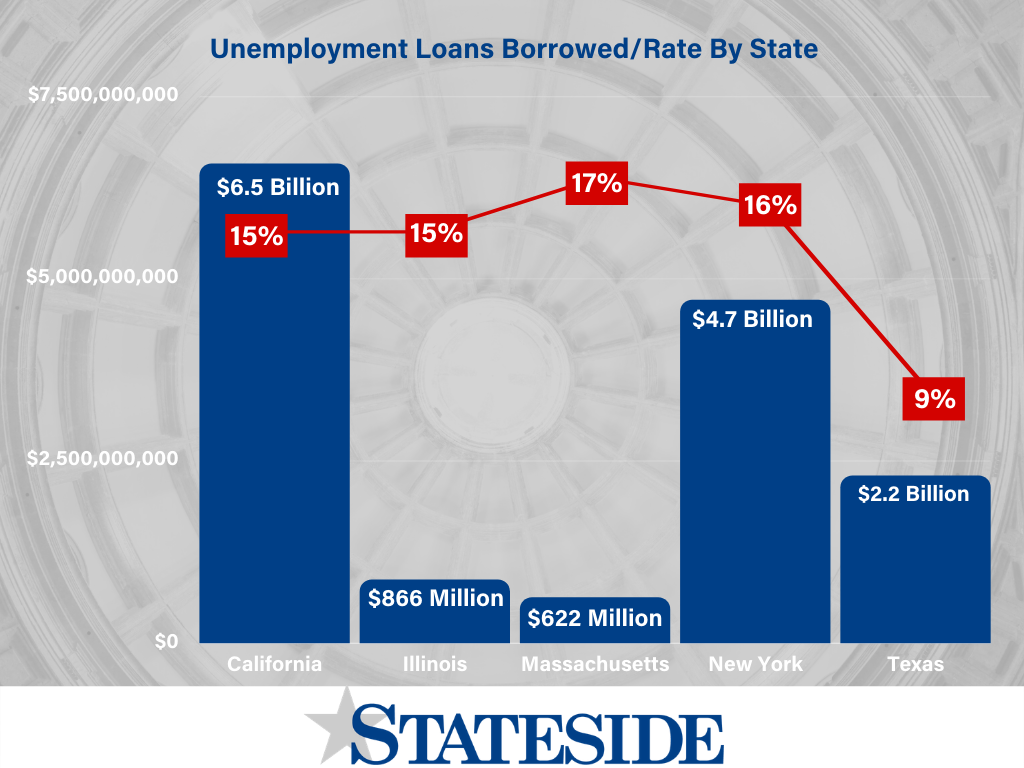

According to data from the U.S. Treasury Department and the Department of Labor, at least nine (9) states currently have outstanding loans from the Unemployment Trust Fund in order to pay their current unemployment claims. These states, including New York, California, Texas, Illinois and Massachusetts, are also looking at revenue shortfalls that will make paying back these debts even more difficult. California and New York currently have shortfalls that exceed their rainy-day funds and CARES Act funding, which constitute a fiscal challenge even without factoring in these additional liabilities.

With the expiration of the federal supplemental benefits having passed, some states are considering increasing their unemployment payments to offset the lapse. Negotiations continue between U.S. House and Senate Republicans and Democrats with both sides hoping for a deal by the end of the week, but both sides remain far apart on the federal supplemental amount. A California legislator introduced a proposal for the state to fund the $600 a week supplemental if it is not included in this round of funding. The Trump administration is also considering a plan where the Department of Labor provides additional loans for states to increase payments to laid-off workers.

With some states rolling back reopening plans because of spikes in positive cases, it is unclear how long it will take before unemployment claims begin to decrease. Until then, the full impact of the COVID-19 pandemic on the workforce and the total amount of money needed to continue to pay unemployment claims may not be known.

At Stateside we are committed to helping our clients navigate the state and local legislative changes brought on by the COVID-19 pandemic. Ask us about our customized reporting and how our insight can help your organization with changes that will affect your business.

Edgar Velasco leads Stateside's monitoring and analysis of the many facets that make up state budget policy. Edgar has experience interning for the New York State Assembly, NASA, and MetLife, and has worked as a Legislative Assistant in the Puerto Rico State Senate for Majority Leader Carmelo Rios. Edgar passed the Chartered Financial Analyst (CFA) level 1 exam and has a passion for finance and fiscal issues, particularly as they intersect with public policy. Complete bio here.