By: Stephanie Reich, Vice President, State & Local Issues

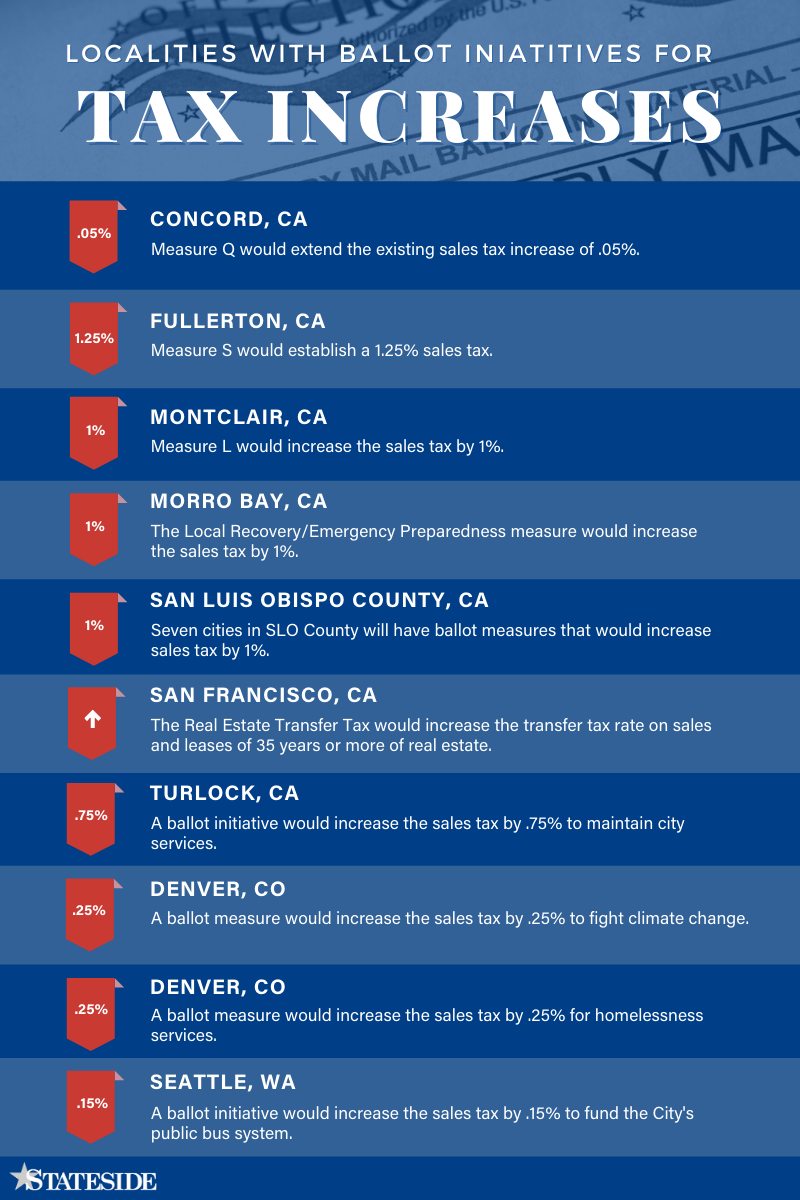

Municipal revenue crises are not a new or recent phenomenon, but this November more local jurisdictions will be asking voters to approve tax increases that in some areas are intended to plug budget holes while others are taking advantage of a shift in the political climate and civil unrest in order to ask voters to fund partisan policies.

Municipal revenue crises are not a new or recent phenomenon, but this November more local jurisdictions will be asking voters to approve tax increases that in some areas are intended to plug budget holes while others are taking advantage of a shift in the political climate and civil unrest in order to ask voters to fund partisan policies.

While hundreds of local jurisdictions in California already added ballot measures to approve bonds, increase sales and parcel taxes, there is still ample opportunity for more to be added before ballot deadlines which have been extended to as late as the end of August. This comes after the March primary where voters rejected 60% of local tax ballot initiatives.

Typically, local officials are limited in how they manage their finances by state constitutions. Cities are looking for ways to create new taxes and fees including those on businesses, rental properties and franchises as well as new regulations to raise revenue and provide services.

Seattle City Council recent passing of the “Tax Amazon, COVID-19 emergency relief bill” is an example of addressing both the current crisis while also pursuing a revenue source that voters rejected in 2018. While the bill was framed to help with the unexpected costs of the pandemic, it is also planned to fund social housing, the Green New Deal and a massive jobs program post COVID-19. This might not be a ballot initiative but it is an example of how a new tax or fee can also inadvertently cause a reduction in spending and an increase in migration. Amazon has recently begun considering moving outside of the city.

While voters have the choice to fund new tax increases the shift in the future of work to a larger remote workforce is creating opportunities for companies and high earners to relocate to new locations, often with lower taxes. This will test these measures and the populations elasticity and commitment to remaining in high tax jurisdictions. The results may also provide insight to state officials who will have to deal with significant budget gaps for the 2021-2022 fiscal year.

At Stateside, we track local government actions, proposed ordinances and other relevant agenda items for over 7,500 local jurisdictions so that our clients are armed with the knowledge needed to make the right business decisions. Contact us today to learn how we can help you stay ahead of the curve.

Stephanie Reich provides our clients with advocacy consulting, strategic planning and State and Local Groups engagement support. As vice president of state and local issues, she manages Stateside’s Local Government Monitoring practice. With nearly 20 years of corporate government relations and public service experience Stephanie brings Stateside clients unique expertise and an extraordinary network. Complete bio here.